An annuitant is paid $495 per month, highlighting the importance of understanding annuities and their role in financial planning. Annuities offer a structured and reliable stream of income, making them an attractive option for retirement planning and managing long-term financial goals.

This comprehensive guide delves into the intricacies of annuities, empowering readers with the knowledge to make informed decisions about their financial future. We explore the different types of annuities, their advantages and disadvantages, and how to calculate their present value, ensuring readers gain a thorough understanding of these valuable financial instruments.

Annuitant’s Monthly Income

An annuitant receives regular payments, known as an annuity, from an insurance company or other financial institution. In this case, the annuitant is paid $495 per month. An annuity is a financial product that provides a steady stream of income over a specified period or for the lifetime of the annuitant.

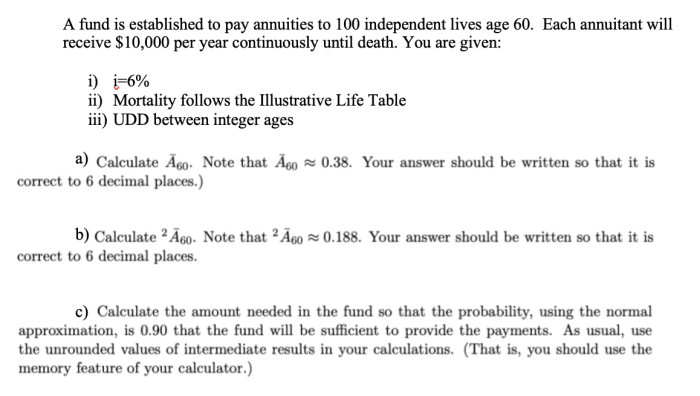

Annuity Calculations

The present value of an annuity is the current worth of all future payments. It can be calculated using the following formula:

PV = PMT x [(1

(1 + r)^-n) / r]

where:

- PV is the present value

- PMT is the monthly payment

- r is the interest rate

- n is the number of payments

For example, if the annuitant’s monthly payment is $495, the interest rate is 5%, and the annuity term is 20 years (240 payments), the present value of the annuity would be:

PV = $495 x [(1

(1 + 0.05)^-240) / 0.05] = $72,844.62

Types of Annuities

There are several types of annuities, each with its own advantages and disadvantages:

Fixed Annuities, An annuitant is paid 5 per month

Fixed annuities provide a guaranteed interest rate for a specified period. They are considered a low-risk investment option.

Variable Annuities

Variable annuities offer the potential for higher returns but also carry more risk. The investment portfolio is tied to market performance.

Indexed Annuities

Indexed annuities offer a combination of fixed and variable returns. They provide a minimum interest rate but also allow for potential growth based on an index, such as the S&P 500.

Annuity Investment Strategies

Annuities can be used as part of a retirement income plan or as a hedge against inflation. For example:

- An immediate annuity can provide a guaranteed income stream for retirees.

- A deferred annuity can allow for tax-deferred growth of savings.

- An inflation-indexed annuity can help protect against the rising cost of living.

Taxation of Annuities: An Annuitant Is Paid 5 Per Month

Annuities are subject to different tax rules depending on the type of annuity and the withdrawal method. In general:

- Withdrawals from a tax-deferred annuity are taxed as ordinary income.

- Withdrawals from a Roth annuity are tax-free if certain conditions are met.

Quick FAQs

What factors influence annuity calculations?

Annuity calculations consider payment frequency, interest rate, and annuity term.

What are the advantages of fixed annuities?

Fixed annuities offer guaranteed payments and protection against market fluctuations.

How are annuities taxed?

Taxation of annuities depends on the type of annuity and the timing of withdrawals.